After seven years of consistent declines, the Manitowoc Public School District is reporting its second consecutive rise in the tax rate.

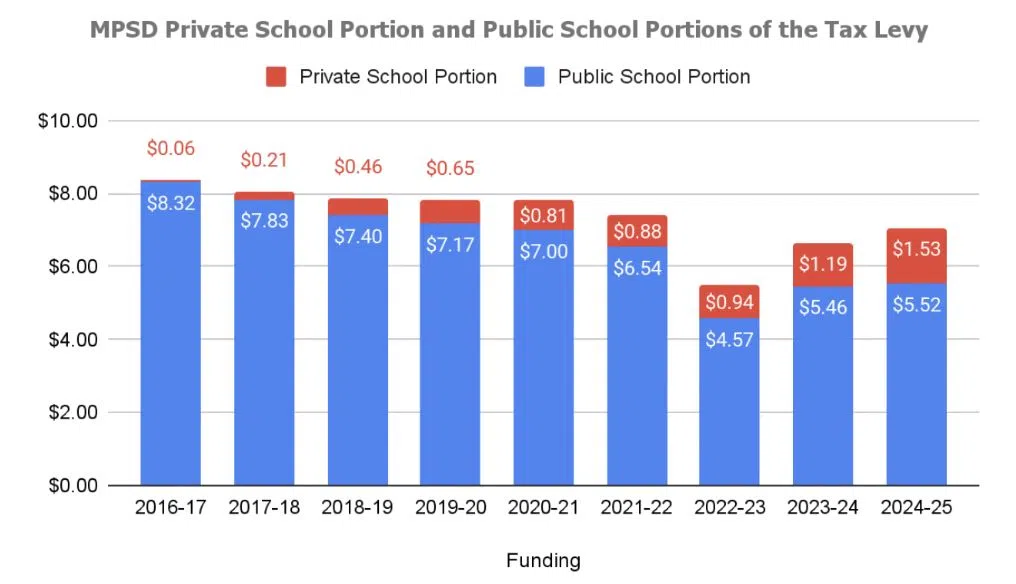

In a news release, Interim Superintendent Lee Thennes shared a graph (which can be seen below) which shows that between 2016 and 2021, the tax rate slowly decreased from $8.38 to $7.42.

Then, in 2022, the rate dropped significantly to $4.57 before rebounding back up to $6.65 in 2023.

This year, the tax rate is rising again to $7.05.

Thennes noted that of the $7.05 rate, “$5.52 is distributed to the MPSD and $1.53 is distributed to private schools under the state voucher program. MPSD’s share increased by just 6 cents, and private schools’ share rose by 34 cents.”

What this means for local tax payers is the owner of a $100,000 home will pay a total of $705 in school property taxes, with $552 going to the MPSD and $153 going to the private schools.

Thennes closed his report by saying, “Moving forward, the MPSD will prioritize efforts to maintain a stable tax levy and rate. Because staffing costs represent the largest part of our budget, a district administrative team is reviewing ways to adjust staffing levels to better match the district’s enrollment, with a goal of cutting costs and the tax impact on local residents.”